summit county utah sales tax

The Treasurer is responsible for the banking reconciliation management and investment of all Summit County funds. Some cities and local governments in Summit County collect additional local sales taxes which can be as high as 5475.

Manage Summit County Funds.

. The Summit County Council established the Restaurant Tax Advisory Committee to investigate advise and recommend. 6 rows The Summit County Utah sales tax is 655 consisting of 470 Utah state sales tax and. Utah Sales.

Sales Tax Calculator Sales Tax Table. The Utah state sales tax rate is currently. Access Utah sales and use tax rates on the Utah State Tax Commissions website.

Utah State Tax Commission Distribution of Sales and Use Taxes And Other Distributions Summit County CoCity 22000 Sum of Payment Tax Type Distrib Period Arts Zoo County Option E-911 Liquor Mass Transit Restaurant Sales Transient Room Addl Transit. Bids Request for Proposals. The entity that had the second highest swing was Summit County government.

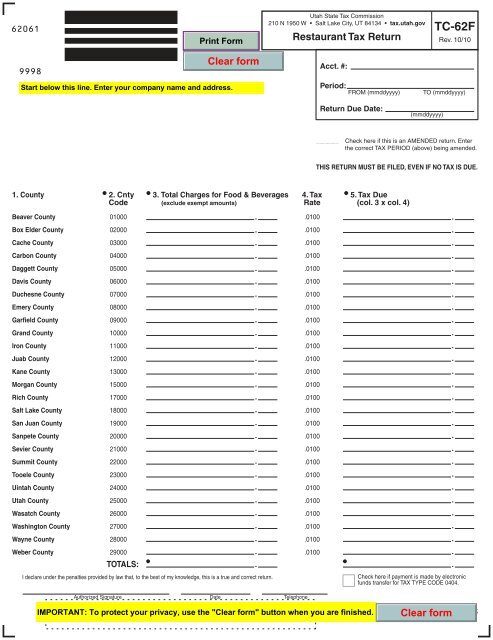

The Summit County sales tax rate is. -Open the most recent Other Rate Chart. Report and pay this tax using form TC-62F Restaurant Tax Return.

The primary purpose of the Restaurant Tax Grant is to promote tourism as set out by the Utah State Statute and the County Council. A sales tax license is not needed from the county. Automating sales tax compliance can help your business keep compliant with.

The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. The state sales tax rate in Utah is 4850. Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06.

State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes. Some cities and local governments in Summit County collect additional local sales taxes which can be as high as 125. A county-wide sales tax rate of 2 is applicable to localities in Summit County in addition to the 29 Colorado sales tax.

To review the rules in Utah visit our state-by-state guide. See Utah Code 59-12-602 5 and 59-12-603 1 a ii Pub 55 Sales Tax. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor.

Average Sales Tax With Local. The Summit County Treasurer is responsible for the collection distribution and reconciliation of property taxes levied by all of the taxing entities in Summit County. If you require additional information about Park City sales tax please contact.

The Summit County Sales Tax is 2. Summit County Utah Recorder-4353363238 Assessor-4353363211. Beer Alcohol Licensing.

Utah has state sales tax of 485 and allows. The Summit County 2021 Tax Sale will be held on. 8 rows The Summit County Sales Tax is 155.

Complete the online building application. Rates include state county and city taxes. All entities and individuals doing business in Summit County are required to pay sales tax.

ST State Sales Use Tax LS Local Sales Use Tax CO County Option Sales Tax MT Mass Transit Tax MA Addl Mass Transit Tax MF Mass tran Fixed Guideway CT County Option Transportation HT Highways Tax. State sales tax and 125 of the affordable housing tax are not charged on the purchase of food. Then look for Park City under Summit County if you are a vendor that needs to collect sales tax for a temporary amount of time Park Silly Market etc please contact the Utah State Tax Commission for more information.

Access county bids and request for proposals. The restaurant tax applies to all food sales both prepared food and grocery food. Summit County charges sales tax and mass transit tax on the purchase of all goods including food.

A county-wide sales tax rate of 155 is. Conference Room Policy PDF Flood Plain Maps. Summit County Home Page.

The countys 2021 sales tax collections were up about 23 compared to 2019 and up about 35 compared to 2020. You can find more tax rates and allowances for Summit County and Utah in the 2022 Utah Tax Tables. County County Public Transit.

Unincorporated Summit County uses Park City as the mailing city and is generally ZIP Code 84098. The entire combined rate is due on all taxable transactions in that tax jurisdiction. The 2018 United States Supreme Court decision in South Dakota v.

This means that depending on your location within Utah the total tax you pay can be significantly higher than the 485 state sales tax. The Summit County Sales Tax is 1 A county-wide sales tax rate of 1 is applicable to localities in Summit County in addition to the 575 Ohio sales tax. Utah UT Sales Tax Rates by City.

Utah has a 485 statewide sales tax rate but also has 128 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2108 on top of the state tax. Has impacted many state nexus laws and sales tax collection requirements. 2020 rates included for use while preparing your income tax deduction.

With local taxes the total sales tax rate is between 6100 and 9050.

Tax Rates Utah County Treasurer

Park City Parade Of Homes Lane Myers Construction Utah Custom Home Builders Modern Lake House Mountain Home Exterior Dream House Exterior

Form Tc 62f Restaurant Tax Return Utah State Tax Commission

6691 Cody Trl Park City Ut 5 5 Baths In 2021 Summer Sky Park City Utah Style

4106 W Sierra Dr Park City Ut 84098 3 Beds 3 5 Baths Park City Mchenry Great Rooms

News Flash Summit County Ut Civicengage

Woodland Hills Showstopper Estate At Summit Creek Lists For 2 175 Million Parade Of Homes Custom Homes Home Builders Association

For Sale 9 750 000 Step Inside A Mountain Estate Unlike Any Other Greystone At Glenwild Located Within The Private Gates O Park City Ut Park City Mansions

10 For 20 At Purple Turtle Pleasant Grove Discount Coupon Purpleturtle Hamburgers Discount Pleasantgrove Diner Purple Turtle Pleasant Grove Turtle

Utah Sales Tax Rates By City County 2022

What Would Our Co Rivers Look Like Without Water Water Resources Water Natural Landmarks

Do You Make The Cash To Be In Utah S 1 Percent Cash Utah Investing